Bank Smarter, Not Harder: The Best Mobile Banking App Features

Customer satisfaction is key to any app’s success. And the best mobile banking app features elevate the customer experience.

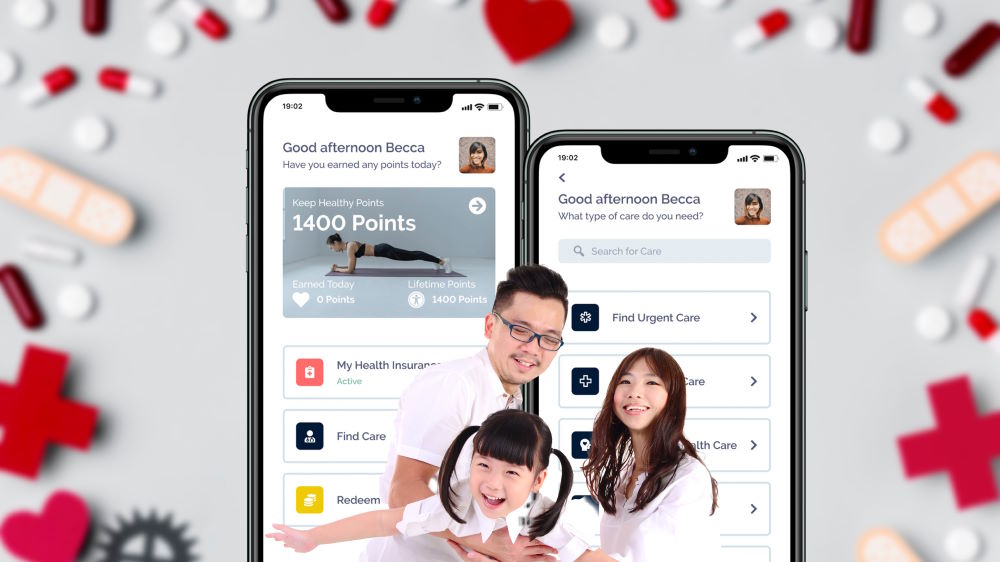

Speaking of digital transformation, we have been witnessing the power of advanced technologies and will keep on being surprised by how they are capable of transforming our lives. In the realm of insurance business, the advent of software solutions is changing how the industry itself functions. That’s why we got a noteworthy transition toward mobile insurance application development which is an acknowledgment of privileged benefits offered by cutting-edge technologies.

Looking at the insurance market at the present time, you recognize the rise of platforms for mobile insurance services. In 2023, the global insurance platform market was valued at $81.7 billion, and this number is forecasted to be worth $156 billion by 2028.

It is a no-brainer that the innovative use of technology – which covers a large scope beyond custom mobile apps - in insurance, known as InsurTech, rocks the real-time B2C interaction between insurers and service providers. Are you venturing into insurance app development on your own? Or are you planning to find the right mobile app development company and entrust them with this task? Either way, let’s equip you with all the essentials before jumping on the bandwagon.

Like in fintech, insurance apps, in particular, and insurtech, in general, are meant to simplify traditional processes, making them more customer-centric and tech-driven. In the following sections, we are going through the clarification of the mobile insurance app development essentials, as well as a list of features to include in your app.

A mobile insurance application is a digital platform wherein insurance agents, providers, and end-users or customers connect with ease and convenience. These innovative solutions (can be mobile and web applications) function to streamline various procedures and aspects of managing insurance offerings, contracts, and settlements, ranging from enrollments to claim submission, support, and everything else involved.

In addition, an insurance agency app acts as a portal where policyholders can share while insurers can access information on-demand, such as insurance policies, premium calculations, notifications on renewal dates and payments.

Like other types of software, the standardized features are what roll out the red carpet for a launched insurance app, while the personalized ones are what set custom software apart from the rest. The customization can be made at one’s disposal. Still, a standard application allowing insurance companies to engage with their clients better and manage their services effectively must include the following features:

The very first experience users will have with an insurance app is the user registration. This basic feature leads users through the process of creating their accounts with a user-friendly interface. App developers must ensure their platform has a secure login process as it involves confidential user information, such as name, email address, contact number, and password.

The dashboard or control panel is the central user interface designed for users to browse the app’s functions and administer their data at a personal level.

This feature often includes two sub-functions - claim submission and claim tracking.

For the former, insurers can fill in forms with their personal information and submit relevant documents (such as photos of damage or police reports) right on the platform. With all the processes of personal form submission and approval carried out digitally, there is no need for users to go through tedious paperwork or signature procedures as well as travel back and forth to the physical offices.

In the latter, insurers are enabled to follow up with the status of their claims, from submission to approval and payment. A well-designed insurance application must include a simple tracking system so that the users have no difficulties monitoring their claims on the way.

With this duo digitalized within one app, insurance providers, policyholders, agents, and insurers can save time and effort.

One of the core functions that complete a mobile insurance app must be policy management - which allows users to access and view details of their policies, including coverage details, payment dates, and renewal options. With a centralized repository, users can track and make changes or upgrades to their policies with ease.

Insurance apps nowadays must integrate secure and efficient payment gateways for users to make payments for their premiums and purchase additional coverage. Recently, mobile payments and other contactless payment options have been on the rise. Thus, insurance apps cannot stay out of the trend. Offering different methods enables insurers to accomplish their payments at their own convenience.

Push notification is the basic feature needed in any digital platform, and mobile insurance apps are no exception. Reminders or alerts are sent out in real time to inform users about the latest changes in insurance policies and related information.

Last but not least, any digital platform needs customer support, and so do mobile insurance apps. Live support is the feature of real-time communication, which creates a channel for users to consult insurance agents for inquiries or assistance. Or, users can leave messages and wait for later replies. Through the in-app communication channels, insurers can directly give user feedback if they do not prefer rating or reviewing the insurance digital solutions on the Apple App Store or Google Play.

With an exciting future of AI adoption, mobile app developers have integrated AI-powered chatbots into insurance platforms, which makes it possible for them to address common issues or answer FAQs without human support. In addition to relieving stress and workloads on human supporters, the presence of artificial intelligence and machine learning technologies contribute to creating personalized experiences for users as well as smart recommendations based on user history and needs.

Please note that these are not everything a regular insurance mobile app can have. Its functionalities heavily depend on the one who creates and owns it as well as whom they serve in the insurance sector.

In reality, the insurance coverage is broad and quite comprehensive. In the current global insurance market, there are different categories of services; hence, the types of applications vary accordingly, with functionalities built for the niches of each type.

Thus, it is essential for any insurance company or development team to consider the service category grouping before taking the first move with one, for example, health insurance app development.

As the term implies, this is a category of insurance products designed to focus on personal values and protect individuals from financial losses due to incidents or foreseen events. Personal insurance services are meant to provide financial security and bring peace of mind by covering the costs associated with accidents, sicknesses, property damage, or even deaths. This type of insurance umbrellas a range of sub-type services and covers a variety of aspects of one person’s life. It can be health, life, families, properties, or liabilities.

Mobile applications under this service category cater to the insurance aspects through the lens of a company or organization. Business insurance offers protection against a broad range of risks and unexpected losses that businesses face in their operations, such as property damage, accidents, bodily injuries, natural disasters, lawsuits, and others.

The last group comprises all the insurance services that do not fall into the first two general categories - e.g., travel insurance, pet insurance, etc. It can be niche or hybrid types of insurance services or products, catering to the specific needs of the target audience base rather than covering a range of risks like personal or business insurance.

Absolutely, software solutions for insurance purposes are needed not only for the clients/insurers but also for the service providers themselves.

Technically, mobile-app-based services are how insurance companies appeal to prospects and overextend the traditional audience base to reach out to tech-savvy younger generations.

The use of mobile apps facilitates the straightforward and responsive connection between insurers and insurance agents or providers. By eliminating the barriers and middle procedures among all parties, insurance digital solutions add convenience and accessibility, such as instant cross-border access, support, personalized offers, real-time tracking, etc., to policy management and maintenance.

Customers can access the platform anytime from anywhere to renew policies, file claims, and check policy status - within a few taps. Speed and efficiency gains from mobile app usage translate into better customer satisfaction or further increase retention and loyalty. Additionally, it is a win-win situation when insurance providers can also gather valuable insights into customer behaviors or preferences on the platform.

Traditional insurance companies usually have to deal with a huge bulk of paperwork and manual data entry, which are prone to human errors, not to mention the time-consuming verification and validation processes. The meaning of the deployment of digital solutions in insurance is to automate as many manual processes and routine tasks as possible, thus easing the pressure on the operational teams.

From policy issuance, premium payments, and claim reporting to document verification, all these formerly time-consuming duties are now considerably offloaded thanks to software systems. Daily operations will be less stressful, and a lot of time, money, and resources can be saved for more rational allocation.

Further than a tool, an insurance application is a new normal channel for businesses to build up their brand images online. Insurance digital solutions are not only about convenience of service provision but also a potential medium for marketing purposes. Such apps are embedded with promotional features, such as in-app advertisements, popup ads, banners, messages, etc., in order to raise the brand awareness of users or inform them about the latest brand announcements or promotions.

Frankly, one of the simplest reasons to have insurance mobile apps is not to become obsolete or outperformed by other competitors who already offer their services through digital systems. With the escalating reliance on smartphones and tablets in everyday life, mobile apps are crucial parts of modern business growth.

Just imagine what a customer will do if he/she has to consider choosing between two insurance service providers - one with a mobile app and one without. It is much more likely that the customer will choose the one with a mobile app for convenience and modernity. Or at least have access to all insurance-related information at their fingertips.

Get ready to build an insurance app for real? Such an app asks for investments at different levels based on the complexity, scale, and functionalities it bears. The variables will also impact the overall development cost and duration.

Are you an insurance provider? Are you searching for professional aids to handle the project of a robust mobile app to serve your customers? You have come to the right place. Here, you’ll find the right app development company.

We are Orient Software, and we are experts in custom software development. With almost two decades of staying relevant in the IT outsourcing industry, we will be your extended hands if you require any assistance in terms of technical stack, personnel - a dedicated team or augmented staff, experience, or anything else.

Hesitate no more to contact us for a free consultation. Our experts are waiting for you. Let’s get on the ship with us and steer it toward victory.

Customer satisfaction is key to any app’s success. And the best mobile banking app features elevate the customer experience.

Leverage legacy code, assure regulatory compliance and a data-driven approach are among the best tips of fintech software development.

As the digitization wave is hitting the financial sector, it is time to transform your financial plans with a suitable wealth management app!

How to make a game app? Explore genres and success stories, and get a step-by-step guide to kickstart your development journey.

Discover the best TestFlight for Android alternatives for your app testing and deployment. Stay ahead with our in-depth analysis.