Will AI Replace Bankers? Top Use Cases of Generative AI in Banking

Could your future financial advisor be an AI? From loan approvals to fraud detection, generative AI is already reshaping the financial services industry. Yet there’s still confusion about how it really works and whether it threatens or empowers bankers. In this article, we’ll cut through the hype and uncover the real impact of generative AI in banking.

Content Map

More chaptersThe banking industry has never stopped evolving. Since the initial ATM, through the emergence of mobile applications, each technological advancement has transformed the way financial institutions engage with their clients. The other disruptive technology of the future is generative AI, and it will be even more disruptive than the last one. The anxiety is tangible, and everybody wonders: Will AI displace bankers?

Although the possibility of a completely automated bank with no human factor might look like a piece of science fiction, the numbers tell a clear scenario of a transitioning workforce. A study by Goldman Sachs shows that 2.5% of positions in the US, including jobs in the accountancy and credit analyst fields, are highly vulnerable to being automated by AI.

However, a closer look reveals that this isn’t a simple story of replacement. Instead, a more nuanced narrative of augmentation is taking shape. Generative AI is not aimed at reducing human expertise but enhancing it, as it will allow bankers to avoid the repetitive, low-value tasks and concentrate on high-value activities such as client relations and solving complex problems. This paper will discuss the best applications of generative AI in banking sector, both in automating the back office and transforming the customer experience, and how this exceptional technology is fundamentally redefining the job of financial practitioners to their advantage.

How Was Generative AI Integrated into Banking?

Before we can see how generative AI has been applied to banking, it is important to first define what this technology is. Generative AI is a sub-field of artificial intelligence that extends beyond data analysis to the generation of new output, including text, code, or financial reports, via learning based on large datasets.

AI in banking is not a new concept: the systems that identify suspicious card usage or recommend savings products based on previous behavior have been around for a long time. The mechanisms rely on principles and pattern recognition. Generative AI, however, goes a step further. It is not just capable of detecting what exists but can also come up with new solutions. You could imagine it as the difference between using a calculator, which merely gives you the correct answer, and a system that not only gives you the answer but also proposes alternative ways to arrive at the same answer, which are sometimes quicker and more efficient than the conventional one.

Generative AI is empowered by three core capabilities:

- Natural language generation: the capability to convert complex financial terms into comprehensible explanations or to have natural discussions with clients.

- Predictive modeling: the ability to envision the future, enabling banks to know when a market risk or a shift in the market will occur.

- Automation: the ability to automate repetitive, time-intensive processes, like compliance reporting or handling loan applications, so that the staff can devote more time to other value-added activities.

These abilities are no longer intangible. Chatbots in the banking industry can now offer customized financial advice, fraud detection systems can identify any hidden patterns in transactions, and complex processes due to the required documentation can be simplified with automated data mining and report creation.

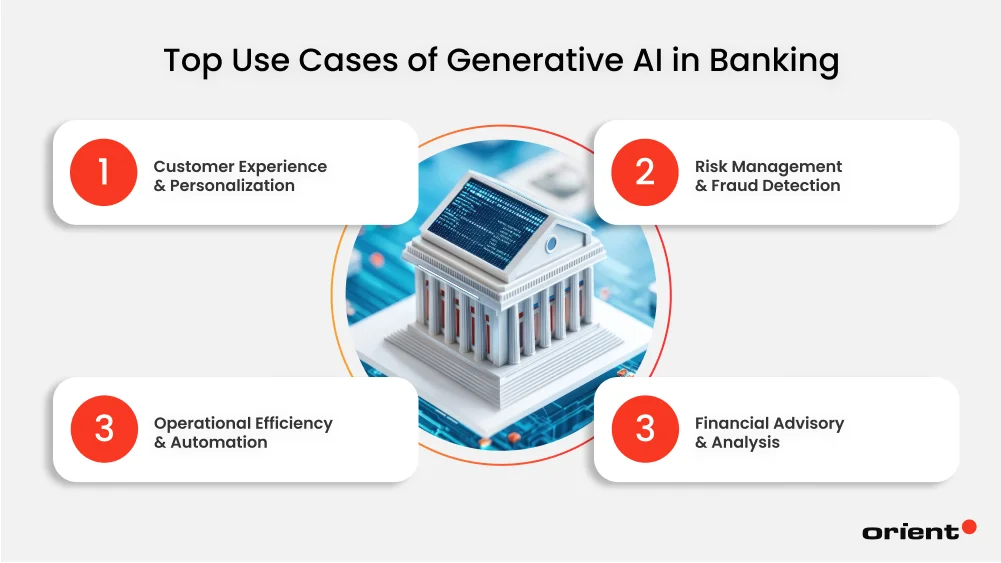

Top Use Cases of Generative AI in Banking

In order to see where the generative AI in banking is heading, we first need to examine the strongest bases that banks are presently implementing in it.

Customer Experience & Personalization

Morgan Stanley has already incorporated the GPT-4 application of OpenAI to support its wealth managers. The tool is so fast to search and summarize the huge storage of research and information of the firm that advisors can quickly locate the information of relevance and create individual reports to clients, improving the quality of their interaction with clients.

Intelligent Conversational AI

In the past, banking chatbots were like automated phone menus: you pressed the right button and hoped you were directed to the right place. Generative AI changes that. Today’s chatbots have the listening capacity of a patient banker who is on call at 2 a.m. and can listen to you not only by comprehending the words but also the underlying meaning. The outcome is a discussion that does not feel as much like speaking to software but rather receiving advice on your finances.

This change opens up another form of support. The chatbot not only provides stock responses but may instead pick up on a sudden increase in your spending and recommend how you can reorganize your spending, or it will guide you on the finer details of a mortgage application. It transforms more personalized financial advice out of routine service, in real time, twenty-four hours a day, and without the irritating delays of phone calls.

Hyper-Personalized Marketing

Banking products and services used to be like lottery tickets, generic emails, or blanket promotions, which were sent out in the hope that someone would read and notice them. What generative AI does differently is that it views a customer as a personality and a story instead of the numbers. It is capable of identifying regular commutes, examining your spending habits, and creating a credit card offer that looks personal to you and, at the same time, one that proposes a savings plan or loan arrangement that fits your actual requirements.

All the recommendations sound as relevant as traditional campaigns could never be. It is not merely a subtle effect but an incredibly powerful one: customers do not just react to it; they get a feeling that they are actually understood and that they identify more with their bank.

Risk Management & Fraud Detection

Mastercard has also used generative AI to enhance fraud detection. The system contains real-time analysis on millions of transactions to detect unusual patterns and foresee compromised credit card accounts. With this ability, the detection rate of compromised cards has reportedly doubled, and the number of false positives has been significantly reduced, thus allowing the banks to block fraudulent transactions much faster.

Advanced Anomaly Detection

Conventional fraud detection systems rely on hard-coded guidelines: alert a transaction where a specific threshold has been exceeded, block a login attempt where there has been unusual activity, or block a series of unsuccessful login attempts. They are effective in familiar risks but fail to detect new and more advanced schemes. This function is transformed by generative AI, which scans through large volumes of transaction data in real-time and finds trends that do not conform to the typical behavior of a customer.

As an illustration, it may pick up a sequence of minor withdrawals at various ATMs that increase to a huge amount, or it can identify that the account of a customer is being accessed unusually. These nuances would be missed by rule-based systems, yet GenAI will be able to detect them as a part of a larger fraud scheme. The outcome is that it is a timely identified, swift response and enhanced protection of both the banks and the customers.

Automated Compliance & Reporting

The aspect of regulatory compliance has always been one of the most resource-intensive in banking. Teams of experts go through documents for hours a day, cross-checking transactions and putting together reports to meet the ever-changing needs. This process can be incredibly simplified by generative AI, which does much of the heavy lifting. It constantly checks transactions, raises suspicions, and creates draft reports, which are of regulatory quality in real time.

Let’s take loan underwriting as a case in point: rather than have human employees go through all the documents manually, GenAI can scan the contracts, process all the data, and prepare a compliance summary that can be reviewed by human employees. To the extent that regulators come up with new reporting requirements, the system can be modified swiftly, and the banks remain current without enormous overhead in their operations.

Operational Efficiency & Automation

In Singapore, OCBC Bank employed a generative AI chatbot in its internal activities, which was used to assist employees in their work, mainly writing and translating documents, summarizing reports, and transcribing calls. This project led to the reported 50% gain in efficiency in internal processes.

Intelligent Document Processing

The banks in the financial services sector have always been shrouded in paperwork: loan applications, contracts, and compliance reports. A lot of these data are in a disorganized form, in PDFs, scanned images, or handwritten forms. Conventionally, employees were forced to search through all pages, get the important monetary information, and rewrite it into the existing banking systems, a task that was not only time-consuming but also subject to errors. Generative AI in banking transforms such a workflow. Having sophisticated AI systems, it is able to work through large volumes of paperwork, identify revenue values, identify gaps in information, or even summarize contracts into several significant risk evaluation aspects.

Practically, loan underwriting and credit risk assessment, which previously took days to be done now can be done in hours. Other than the saving of operational costs, this improves customer satisfaction and operational efficiency that enables financial professionals to have more time to work on strategic decisions instead of paperwork.

IT Architectures Modernization

Still, many banks operate on the basis of traditional core systems that drive vital payment and loan solutions. Overlaying modern apps on top of the former systems is like attaching a jet engine to a steam train: it works, but the innovation is slackened, and the operational cost is increased. This is why IT modernization is an urgent and complicated matter in the banking industry. Generative AI is not only efficient but also fast. Developers are able to code-generate, examine past data of the old systems to create new modules, write their test cases, and even propose system architectures.

It is not only quicker development, but it also provides the banks with the flexibility to react to a fast-changing market. Through AI-based modernization, it will take institutions a few weeks rather than years to start lending platforms or digital wealth tools. It means customized products and a smoother customer experience for customers and diminished risk of disruption and competitive advantage for banks.

Financial Advisory & Analysis

Wells Fargo created an AI-driven solution for its financial advisors, helping them to create a personalized and detailed financial plan for clients. The AI scans through and examines the financial information and objectives of the client to create a complete plan, which the advisor can evaluate and optimize to accelerate the planning process and enable the advisor to work with additional clients.

Augmented Financial Advisors

A generative AI in the banking industry is not merely a number-crunching tool, but instead it acts as a financial strategist at the speed of a machine. GenAI systems do not provide us with stale reports but stream insights in real-time and dig through historical data, market feeds, and even nuanced correlations. Just imagine that you are looking at a dashboard that re-renders itself after every second, displaying how your portfolio changes when interest rates explode. What makes this powerful is not the data itself but the narrative it creates.

GenAI can draft full portfolio summaries that read less like spreadsheets and more like investment stories: “Here’s where your risk lies, here’s how different paths could unfold, and here’s the optimized strategy for your goals.” By weaving analysis into actionable scenarios, it transforms financial data from raw numbers into personalized strategies that feel hand-crafted yet are generated at scale.

Predictive Market Analysis

Market shifts in the financial service sector are like abrupt weather changes. They are hard to predict in advance, move quickly, and have a ripple effect. Generative AI in banking does not simply recreate past data; it simulates output like a climate lab experiments potential storms. Since it works with big volumes of financial information, it is able to give forecasts of what will occur in case the interest rates increase by two points, a conflict in the region alters the oil prices, or a new rule transforms credit risk measurement.

The result of every simulation is the creation of predictive models that map threats and opportunities, providing banks with insight into what would have required weeks to compute previously. Financial institutions will be able to adjust their strategies on a real-time basis to volatility changes, at the same time as they adjust their portfolios, refine their investment banking products, or strengthen their protection against volatility, with the flexibility of having tomorrow’s forecast today.

Key Benefits of Adopting GenAI

Generative AI in banking is not really about individual tools but rather rewires the financial services sector as a whole. Its value affects a number of levels, including the back office, the front line to the customer, and even the competitive front.

- More Productivity and Less Expense: Automation is not just time-saving, but it redefines the value of such time. Financial institutions minimize the costs of operation by eliminating routine operations and liberating capital, which may be directed back to innovation, thus enabling the launching of new products and services faster.

- Enhanced Customer Loyalty: Customers might not remain interested just because you have a chatbot that responds to their query. They remain loyal because their experience of the interaction is always timely and relevant. This scale is facilitated by GenAI, which produces a feeling of relationship that enhances customer satisfaction and churn.

- Strengthened Security Posture: Risk management has been reactive at all times, but GenAI converts the model into a next-level model. Banks can reduce their assets by identifying anomalies and threats before they become a reality, and in the process, project resiliency. This move creates a sense of trust in both the clients and the regulators in an industry where reputation is currency.

- Competitive Advantage: The financial sector is fast-paced, and technology adoption sometimes determines the status in the market. GenAI is not a mere upgrade; it is a step change that can enable banks to establish new standards of service delivery, and once such rivals are left behind, they will find it difficult to catch up.

Why AI Won’t Replace Bankers

Banks in the race to integrate generative AI systems anticipate a faster and cheaper processing of data than ever before. But this is the paradox here, as the more powerful AI becomes, the more ethical risks and trust become critical factors.

The AI system can scan a lot of information within a second, yet it can very easily overlook the non-numerical cues such as the nod, a loose handshake, or the expression of concern on a client’s face. And in some cases, it is specifically such nuances that decide what will happen to a multi-billion-dollar deal.

The Human Element

Trust in the banking and financial services is not established on spreadsheets; it is established within moments of uncertainty, fear, and negotiation. The AI models are capable of crunching data, identifying patterns in customer data that the human brain thinks of as correlating, and even formulating tailored financial advice, but they stumble when the conversation goes beyond data.

Consider investment banking: when a merger deal is on the verge of a collapse, when one of the CEOs suspects that the other is keeping a secret, there is no algorithm that will intervene to restore confidence. Or in managing wealth, when an investor has a panic and decides to withdraw all his money because of a market panic. In such situations, it need a banker’s voice, credibility, and calmness to stop billions from walking out the door.

| Aspect | Generative AI | Human Bankers |

|---|---|---|

| Handling Client Panic | Shows past performance charts, offers scripted reassurances | Reads emotions in real time, calms fears, reframes risk so the client stays invested |

| Boardroom Negotiations | Provides valuation models and probability scores | Mediates power struggles, manages egos, builds consensus so deals actually close |

| Unspoken Cultural Nuances | Cannot interpret silence, gestures, or subtle tone | Deciphers whether a pause means “no,” “maybe,” or “let’s renegotiate” — critical in cross-border deals |

| Ethical Gray Zones | Flags only rule-based compliance risks | Weighs reputational damage, regulator sentiment, and community perception beyond what’s “legal” |

| Bespoke Financial Strategies | Generates model portfolios from historical data | Adapts strategy for messy realities: family politics, succession disputes, or lifestyle-driven financial goals |

The Creation of New Jobs

Each industrial revolution has relocated, not eliminated, jobs. When the mechanical looms came in, they did not eliminate the textile industry, and they did not eliminate the hand-weavers; instead, they created jobs to be occupied by the machine operators, technicians, and supervisors. The generative AI in banking can be explained using the same logic. This is because, as AI systems replace repetitive financial processes, such as document processing or report generation, banks are not eliminating human beings but are reassigning them to jobs where they will provide oversight, interpretation, and strategy.

This change can already be observed. It was revealed in a 2024 Evident Insights survey that 41 out of the 50 largest banks globally had AI governance professionals on staff, nearly twice the number of the year before. Likewise, the number of jobs related to AI increased dramatically: software and implementation of AI jobs increased by 42% in half a year, and data engineering positions by 14%. Wells Fargo expanded its technology force by 20%, and BIDV in Vietnam expanded its IT employees tenfold to meet the demands of digital and AI projects. These statistics are an indication of a deeper truth: rather than displacing humans, AI is building a whole ecosystem of employment around itself.

Banking and technology are meeting at a new intersection, creating new professions. Prompt engineers are emerging as machine whisperers of finance and optimizing queries to get trusted and compliant outputs of generative AI. Data scientists are becoming future frontline strategists, enabling fraud detection, credit risk modelling, and custom financial advice, rather than working in the back office as analysts. The regulators of AI governance and ethical compliance officers also take the role of guardians of trust so that AI systems do not violate laws and safeguard sensitive customer data.

How Bankers Can Leverage AI in Operations

In order to take advantage of AI in the banking business, it is necessary that bankers learn to combine technical expertise with the essential human skills. Although AI is replacing routine work, it introduces a demand for new skills, enabling users to process AI-generated outputs, organize the application of AI, and preserve the non-computational elements of banking.

Data Literacy & AI Fundamentals

One of the basic skills is the understanding and interpretation of data. This does not imply that all bankers should become data scientists, but they have to be data literate. They are expected to learn the process of training AI models, the type of data they need, and how to unbiasedly evaluate the insights that they provide. This includes:

- Understanding Data: Knowing how to source, clean, and structure data for analysis.

- Interpreting Insights: Having the ability to read an AI-based report about the behavior of customers or the risk of fraud and interpret the numbers, instead of merely taking the numbers at face value.

- Prompt Engineering: In the case of generative AI tools, the quality of the prompts is essential to obtaining reliable and useful results. In this case, it is essential to write clear and precise prompts. This entails understanding how to formulate queries in order to drive the AI in a particular direction.

Critical Thinking & Problem-Solving

Since AI will deal with the “how”, the bankers will have to deal with the “why”. This involves critical thinking that challenges the output of the AI, determines the possible biases, and applies the information to complex and non-routine problems.

- Doubting AI Results: It is important to realize that AI models have the potential to make hallucinations or give biased output according to how they were trained. A banker should be capable of knowing when a result does not make sense and digging deeper.

- Complex Problem-Solving: AI is very effective at identifying patterns, but it fails to cope with ambiguous, complex cases. That the capability of a banker to negotiate gray situations, balance various concerns, and make a final and ethical decision comes in very handy.

Adaptability & Continuous Learning

The AI environment is changing at a frantic rate. The state-of-the-art yesterday has become the minimum this day. Bankers have to have the spirit of learning and flexibility in order to remain in the game.

- Always Updating on Technology: This is being aware of new AI features and devices, and having the courage to test them out in a secure environment.

- Adopting Change: The productive banker of the future will not oppose AI-based changes to their working process; they will explore how they can use new tools to improve their own productivity and value.

Ethical Judgment & Customer-Centric Skills

Using AI can take care of the numbers, but not the people. The skills that are most important are the uniquely human ones. With AI taking over most administrative duties, the banker is more of a consultant and in the business of relationship building.

- Empathy and Communication: Trust is built with clients, and this is done through empathy and clear communication that cannot be replicated by AI, particularly when the matter at hand is sensitive, like loans or investments.

- Ethical Oversight: AI models may be biased in nature, including credit score biases. Bankers should be empowered to have the moral sense to identify and manage these biases and treat their clients fairly and equally.

- Client Management: AI tools will give more personalized insights, but a banker is required to translate the insights into a more personalized plan, establish a rapport, and act as an advisor whom the customer can rely on.

The Future of the Banking Professional

The real question for bankers is no longer “Will AI replace us?” but “How far can we go when we master it?”

The successful institutions will be the ones where the professionals view AI as their accomplice rather than their adversary. They leverage it to seek new business opportunities, anticipate the needs of the clients in advance before they even start speaking, and create trust on a new level. For bankers, financial institutions, and tech leaders alike, the challenge now is to reskill, experiment boldly, and form the right partnerships to stay relevant. The path forward is not about holding on to old roles, but about shaping new ones.

Therefore, the question that you must ask yourself today is: are you prepared to be on the forefront of this change or would you see others create the future of banking without you? If you’re ready to act, Orient Software can be the partner that can assist you in transforming vision into reality, bringing in the necessary know-how to assist in this exciting new world.