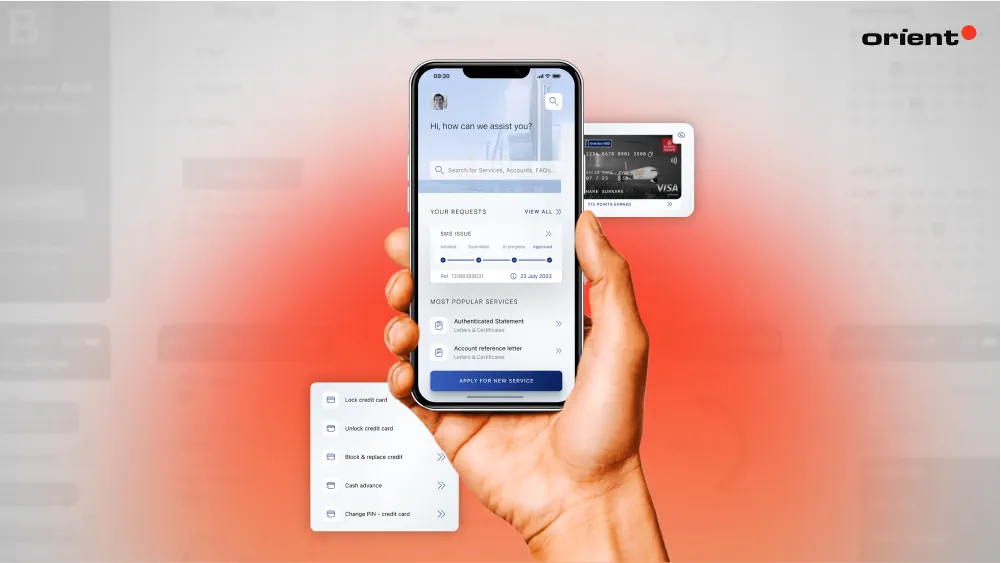

Mobile banking has come a long way over the years. In the beginning they started out as simple mobile apps. They let you view your account balance, deposit and withdraw money, and pay other people or organizations. These days, mobile banking apps let you perform all kinds of tasks. You can manage your investment portfolio, make contactless payments, and even apply for loans.

Regarding mobile banking app development, there are many factors to consider. You must consider your target audience, including their pain points. You must also consider your tech stack, along with security and compliance requirements. Fortunately, that’s where the right mobile app development team can help.

![How Mobile Banking App Development Works]()

Read on to find out all you need to know about mobile banking app development. You will learn what a mobile banking app is and how it benefits banking institutions and customers. We’ll also cover the steps involved in developing one and how to choose the best mobile app development team.

Key Takeaways:

- Mobile banking applications enable users to manage their finances, pursue investment opportunities, apply for loans, and more.

- Developing a mobile banking app involves defining your target audience, their pain points, and the purpose of your app.

- Look for a mobile app development team with experience in the finance and banking sector. They can help you deliver a mobile solution that is secure and compliant.

What Is Mobile Banking App Development?

Mobile banking application development is the process of developing a mobile app for the banking sector. It involves developing apps that let customers perform various banking and financial tasks. All from the comfort of their mobile device, too. Mobile banking apps come in a wide range of types. They can let customers manage their finances, invest in crypto, apply for loans, and make contactless payments.

Mobile banking apps can be either native or cross-platform. That means they can be developed exclusively for one operating system (OS) or multiple. Android mobile banking apps are developed using C#, C++, or Kotlin. Meanwhile, Apple/iOS apps have been developed using Swift. Cross-platform mobile banking apps are developed using React, Flutter, or JavaScript.

How popular are mobile banking apps? A 2021 report revealed 72 percent of people aged from 15 to 24 reported using mobile banking in the past 12 months. By comparison, around 15 percent of those aged 65 or older used mobile banking apps. This trend lines up with the rise of online-only banking services, such as neobanks and buy now, pay later apps.

![What Is Mobile Banking App Development?]()

What Are the Benefits of Mobile Banking Applications?

Mobile banking apps provide numerous benefits to banking institutions and customers. They help banking institutions build brand loyalty and increase customer satisfaction. Wealth management apps help users minimize their tax liabilities and build an emergency fund. Let’s discuss these benefits in detail.

The Benefits of Mobile Banking Apps for Banking Institutions

Mobile banking apps offer the following benefits to banking institutions:

- Improved brand loyalty and credibility – Customers have high expectations of banking institutions. They want their mobile banking experience to be safe, secure, and fast. Banking institutions that offer robust and secure mobile banking apps are more likely to be trustworthy. Customers are more likely to trust them with sensitive user data.

- Increased customer satisfaction – The finance and banking industry is constantly evolving. And so are banking customers’ needs. For this reason, banking institutions should always stay ahead of the pack to keep customers satisfied. Offering 24/7 mobile banking services to customers makes it easier for them to manage their money. And they don’t have to visit a physical branch or make a phone call. This helps customers save time and effort, increasing their satisfaction.

- Improved competitive advantage – Staying ahead of the competition is vital to running a successful banking institution. Those who invest in innovative mobile banking are more likely to stand out. It gives them an opportunity to provide better value to their customers. Whether it be to offer short-term loans or fast contactless payments, specializing in a specific field of mobile banking is a great way to stand out.

The Benefits of Mobile Banking Apps for Customers

Mobile banking offers many benefits to the end user. Here are what those benefits mean for customers:

- 24/7 access to online banking – More than ever, banking customers crave convenience. Few have time to visit a physical branch. Offering 24/7 access via mobile banking is a great way to satisfy banking customers. From the comfort of their own mobile devices, they can do all sorts of tasks. Deposit and withdraw money, view bank statements, and set up direct debit payments. This helps banking customers save time and hassle, making their lives easier.

- Save money – Many mobile banking apps give customers the necessary tools to help them save money. Budget planners help customers better understand their spending habits. They show them how much money is coming in and going out, and they offer actionable advice to help reduce their spending. Mobile investment apps show customers how to diversify their portfolios and invest wisely in low-risk accounts.

- Improved attitude toward money – People who struggle to manage their finances tend to have a negative mindset toward money. The right mobile banking app can help turn things around. Such apps can help customers identify and address their existing poor spending habits. They can also help them set and work toward realistic financial goals. As a result, customers can use their newfound confidence to make smarter financial decisions.

What Are the Key Features of a Mobile Banking App?

The features that you get from a mobile banking app depend on the type of service that it offers. Digital wallets let you make contactless payments in real time, while cryptocurrency apps have features that let you trade, store, and earn crypto.

![What Are the Key Features of a Mobile Banking App?]()

That said, there are core features that are present in most mobile banking apps. Let’s take a look at those now.

- Account overview – Most mobile banking apps let you view basic account details, such as the account name, balance, transfer history, statements, and more. This information gives you a broad overview of how much money is coming in and going out of the account.

- Make payments – Being able to make payments is a core feature of most mobile banking apps. With this feature, you select the recipient or organization that you intend to pay. You then select the desired amount and initiate the payment. Depending on the app, the payment may be immediate, or it could take a few days.

- Set up direct debit payments – It allows you to automate the process of paying certain individuals or organizations. You determine when and how much money will be taken out of your account. As long as there is enough money in the account on the given due date, the direct debit payment will be made.

- Card management – In-app card management lets you manage almost every aspect of your credit or debit card. For example, you can deactivate the card if it gets lost or stolen. This prevents anyone else from using the card for nefarious purposes. Many mobile banking apps let you request a new card, too. You can even unfreeze a card if it comes back into your possession.

- Customer service – More mobile banking apps are starting to incorporate chatbots, guides, and resources into their services. These features help you find information that is crucial to the operation of the app. They also help you answer commonly asked questions. Banking chatbots can help address customer inquiries and, if necessary, escalate a particular matter to a human customer service representative.

While there are many more features to be found in mobile banking apps, the above are some of the most common. Now, let’s see what it takes to develop a mobile banking app.

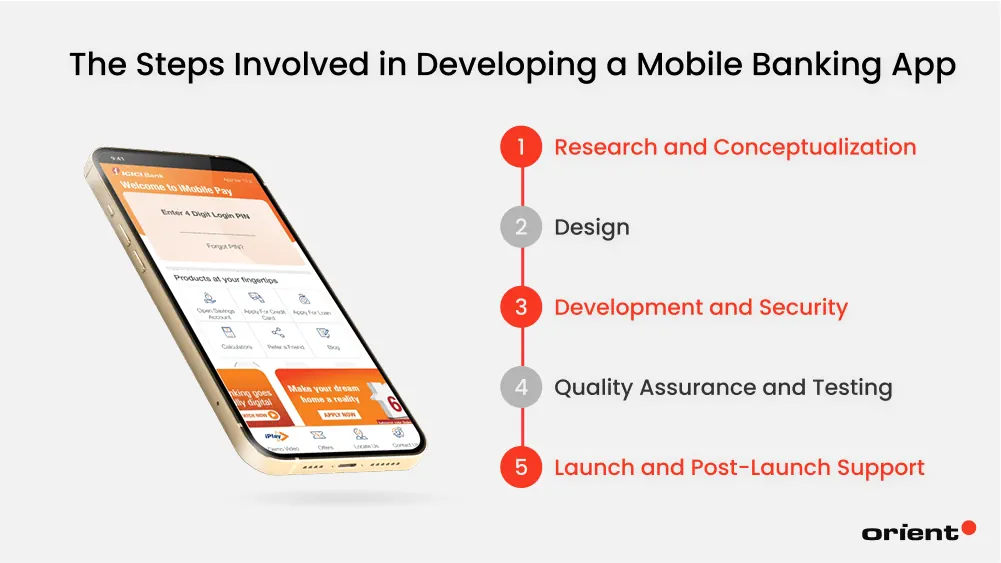

What Are the Steps Involved in Developing a Mobile Banking App?

Developing a mobile banking app can be complex, time-consuming, and expensive. Understanding the journey can help streamline development and accelerate the product to market. Here is a detailed breakdown of the steps to develop a mobile banking app.

![What Are the Steps Involved in Developing a Mobile Banking App?]()

Research and Conceptualization

The first important step is to choose the target audience and pain points. What type of people will use the app? What problems will the app solve? Answering these questions will help define the app’s core features.

Next, define the app’s purpose. Settle on a realistic and achievable goal. It could be to help young people save money by offering smart budgeting tools. It could also be to simplify loan applications. Ensure that the app’s purpose aligns with solving the customers’ pain points.

Also, determine the app’s technical stack. Decide if the app will be a native or cross-platform solution. This will help determine the type of software developers necessary for the job. It will also help narrow down the target devices to develop for.

Design

The next step is to focus on the app’s design. Designers, user interface (UI), and user experience (UX) specialists play a key role in this department. They determine the layout of the app, including the placement of UI elements such as buttons and menus. They also establish the app’s visual theme and character, including the choice of fonts, colors, and branding.

UX specialists ensure that your app meets your customer’s needs. They carefully map out the user journey, ensuring that the app is responsive and easy to use. They also focus on making each feature and action satisfying to carry out.

At Orient Software, our UI and UX design experts are highly skilled in delivering positive mobile app experiences. We take the time to understand your target audience. And we define the journey you want to take them on. This enables us to deliver a visually appealing and responsive mobile banking app that meets your needs.

Development and Security

From there, the software development team can get to work. They will start building the app and implementing the core features and visual elements. The team will also incorporate the necessary cybersecurity solutions into the app.

According to research, 1 in 3 Americans reports being a victim of online financial fraud/cybercrime. Having the right security features can help safeguard your customers’ sensitive data. These include features like multi-factor authentication, data encryption, and authentication controls. These will help protect your users money and instill trust in your app.

Quality Assurance and Testing

One of the last steps to perform is quality assurance and testing. Performed by a dedicated QA and testing team, they carry out a range of tests. They check for performance, security, usability, and device compatibility.

These tests confirm that your mobile banking app will be fast-loading, secure, easy to use, and compatible with your nominated devices and platforms. Most importantly, they confirm that your app meets the design specifications and clients’ requirements.

Launch and Post-Launch Support

Once your mobile banking app is ready to be deployed, the software development team will perform the necessary preparations. They will deploy the app and provide ongoing maintenance and support. They will also respond to customer feedback and address any unforeseen issues with timely updates.

Post-launch support may also involve adding new core features or modifying existing features. Responding to market changes and customer feedback is essential to continuously improving the user experience.

What Are the Challenges of Developing a Mobile Banking App?

Developing a banking app can be a complex and costly endeavor. There are a lot of moving parts to manage, such as the app’s design and functionality. Adhering to compliance requirements is also a complicated process.

These contributing factors increase the risk of mobile app development projects going haywire. They may go over budget, lose focus, or miss a deadline. The good news is that you can avoid these risks by hiring the right mobile app development team.

![What Are the Challenges of Developing a Mobile Banking App?]()

Some of the many challenges of developing a mobile banking app include:

- Meeting compliance – Developing a mobile banking app involves meeting a variety of regulatory standards. The standards that apply to your app depend on where your customers are based. For example, the United States has the Gramm Leach Bliley Act (GLBA), which covers data privacy for financial institutions. At Orient Software, we have experience delivering compliant mobile solutions for the banking sector, such as a cashless payment app for the Southeast Asia market.

- Protecting user data – Mobile banking apps store and manage all kinds of sensitive personal data. These include users’ names, account details, card numbers, and much more. Failing to incorporate the necessary security features could put users at risk of fraud, data theft, and other threats. The cost of a mobile banking app breach could be severe, impacting your reputation and trustworthiness.

- Ensuring usability and functionality – Even though mobile banking apps are complicated by nature, they should still be easy to use. Menus should be easy to navigate, while the features should be simple to interact with. Having clear, legible UI copy is vital to guiding users through every aspect of the app. At Orient Software, we prioritize the user experience from beginning to end. We consider all the actions that users take, from logging in to viewing account balances. This enables us to provide a positive mobile experience at every touch point.

Why Choose Orient Software for Mobile Banking App

When it comes to developing and launching a mobile banking app, you have a lot of important decisions to make. Who will be your target audience? What core features will they need from you? And what outcomes will they hope to achieve?

These are the questions that a software development team with experience building mobile banking apps can answer for you. They can then follow through on developing a secure, robust, scalable, and user-friendly mobile banking app that meets your unique requirements.

![Why Choose Orient Software for Mobile Banking App]()

At Orient Software, we have over a decade of experience developing mobile apps for the financial sector. Our highly skilled team is knowledgeable in all facets of mobile app development, from design to concept to development to quality assurance and testing. These core competencies enable us to deliver mobile banking apps that are lightweight, secure, easy to use, and scalable.

As a result, your app will deliver a positive user experience and be resilient in the face of an ever-changing, dynamic financial landscape.

Build Your Mobile Banking App with Orient Software

The banking and finance sector can be highly complex. For this reason, you need the right software development team. The type of people who have the technical expertise and industry knowledge to best serve your interests. That’s where Orient Software can help.

Discover how our mobile banking software development services can bring your idea to life. Contact us today to learn more.